Cover Photo: Looking northerly over the Lucky Draw Tailings Dam

1.1 OVERVIEW

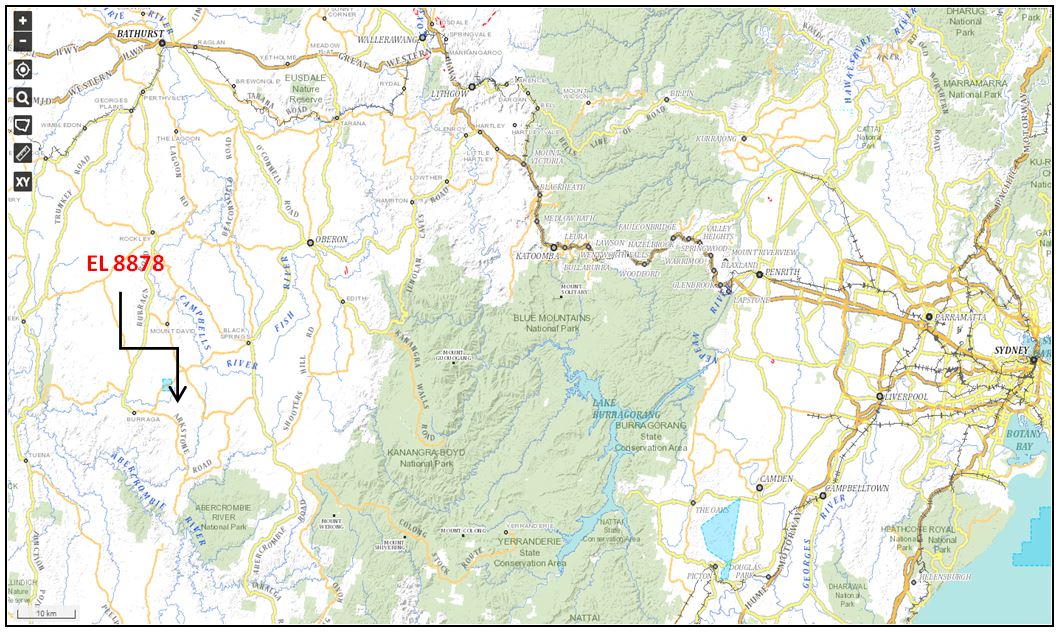

Destiny Resources Pty Ltd (Destiny) has secured exploration title (EL 8878) over the Lucky Draw Tailings Dam located south-west of Oberon, NSW. Some of the main highlights of this Project include:

- JORC (2010) categorised global gold resource of 23,900 ounces of which 21,400 ounces lies within EL 8878

- Partnering with Mining & Process Solutions and Curtin University to apply Glycat proprietary gold extraction technology

- Looking to optimise tailings testing regime under an Innovations Connections (IC) grant

- Preliminary financial modelling suggests robust returns are possible

- Metallurgical test work, planning and environmental scoping studies set to commence immediately with goal of lodging application for a Mining Lease within 6 months

The Company has identified other similar projects which it believes will benefit from the above strategy and will look to create a pipeline of development projects over the coming months and years. An overview of the tailings dam is illustrated in the cover photo.

1.2 INTRODUCTION

Exploration Licence 8878 (EL 8878) covers the bulk of the Lucky Draw Tailings (LDT), which were generated as a result of the mining, and processing of gold bearing ore from the Lucky Draw Gold Mine. The location of the tailings dam project is illustrated in Figure 2.

Historic data indicates that the tailings encompass a gold resource of approximately 24,000 ounces of gold. It is the intention of Destiny to reprocess these tailings and recover a significant proportion of the gold content utilising the most suitable and appropriate gold extraction plant and process.

1.3 TENURE ASPECT

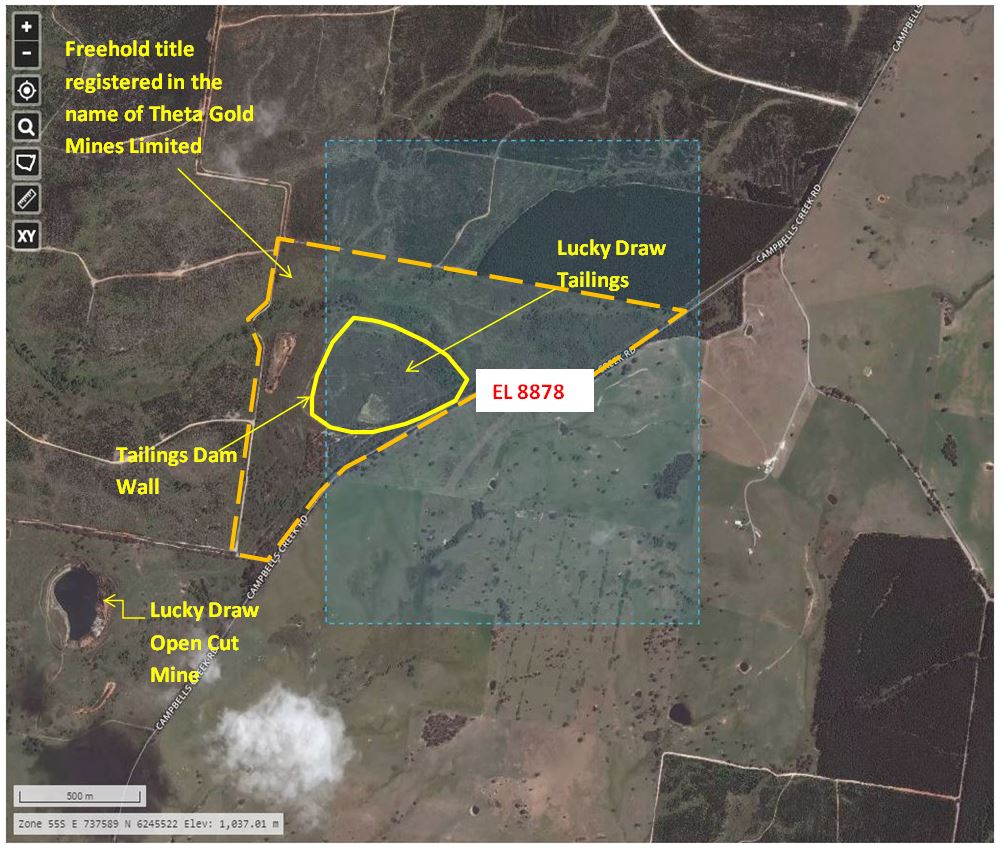

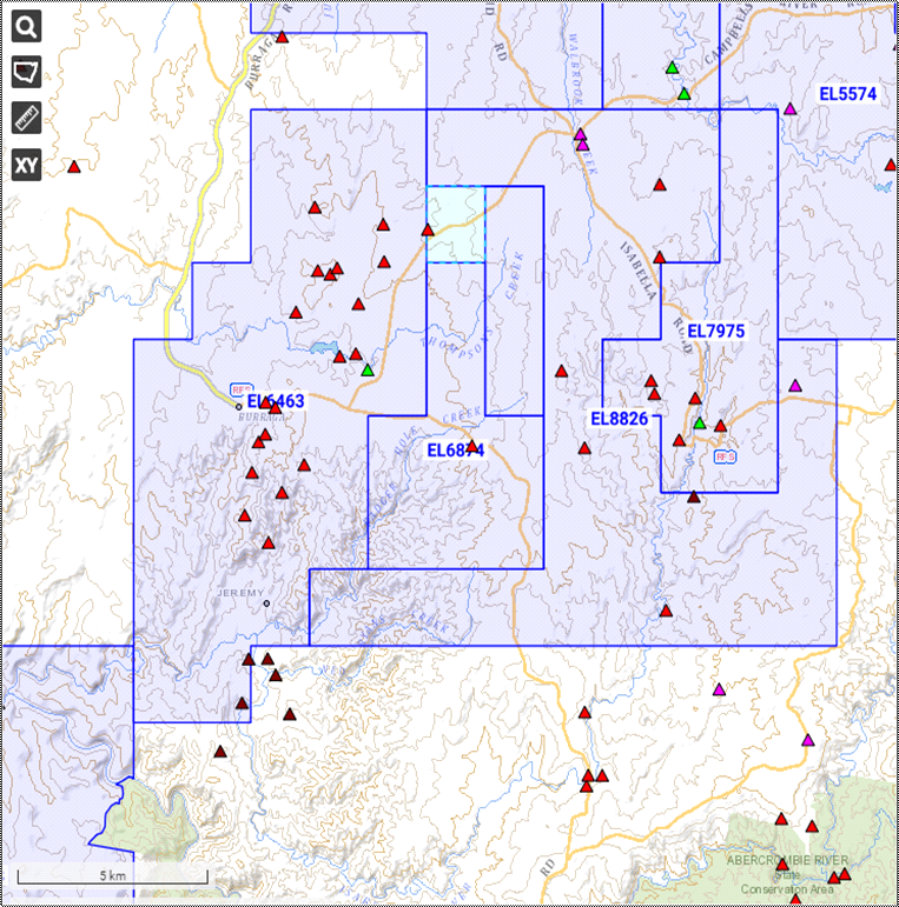

The position of the tailings dam in relation to the licence boundary is illustrated in Figure 3, which indicates that the western boundary of EL 8878 intersects with the dam wall. The land to the west of EL 8878 is currently covered under EL 6463, registered in the name of BC Exploration Pty Ltd, a wholly owned subsidiary of Hardey Resources Limited (HDY: ASX). Hardey Resources Limited tenements also surround EL 8878 to the north, east and south.

The local tenure position is illustrated in Figure 4. For practical logistical and environmental reasons, it will be beneficial to the project to secure title over the dam wall as illustrated and discussions with Hardey Resources to effect a suitable arrangement in this regard, are currently being undertaken.

The open cut Lucky Draw Mine (from whence the tailings were generated) is located approximately 1.0 kilometre to the southwest of the licence area – see Figure 3.

The freehold title of the land is registered in the name of Theta Gold Mines Limited (ASX: TGM). This Company held the Lucky Draw Tailings under exploration title for at least a decade (under predecessor entities) before the title lapsed on 23/3/2019 – see also Figure 3 for property boundary in relation to the tailings dam. Discussions are in train with Theta Gold Mines Limited with respect to an appropriate access and compensation agreement.

1.4 REVIEW OF RESOURCES

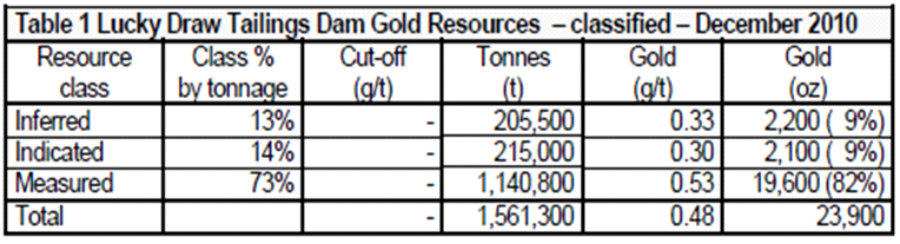

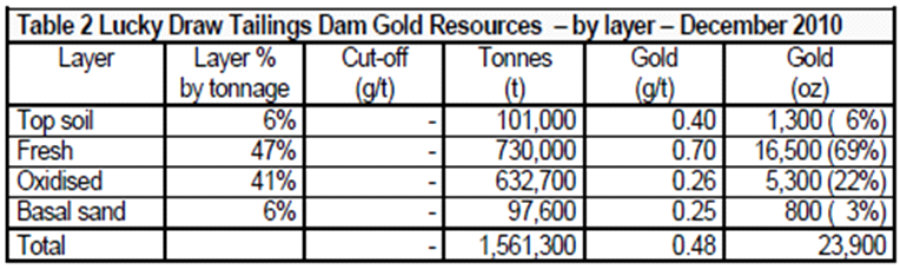

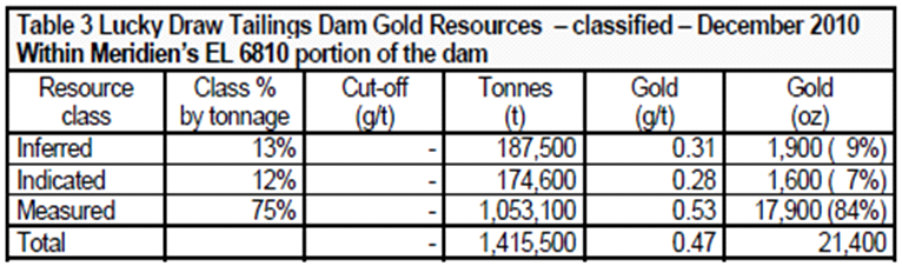

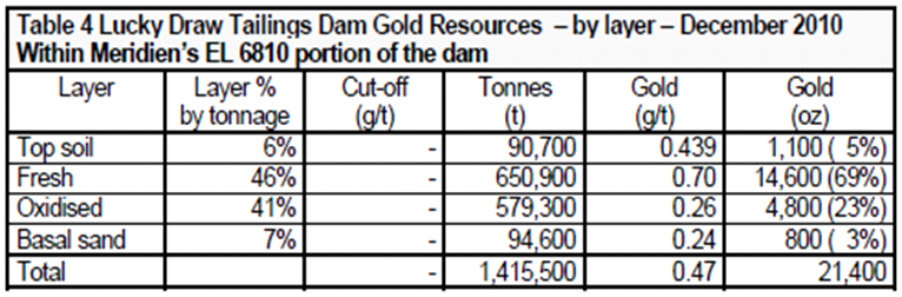

GeoRes on behalf of Meridien Resources Limited assessed the Lucky Draw Tailings in late 2010 compliant with JORC (2004) criteria. The assessment is summarised in Tables 1, 2, 3 and 4. The most significant points of this assessment are:

- The total resource (Inferred to Measured) contains 1.56 million tonnes with an average grade of 0.48g/t Au. 82% of the resource is within the Measured category (Table 1);

- The tailings consist of four (4) separate layers, each of which is gold bearing. The bulk of the gold is found within the “Fresh” tailings holding 69% of the gold inventory (Table 2);

- The “Fresh” tailings is host to the highest gold grade (0.70 g/t);

- A small part of the tailings dam falls within EL 6463 held by Hardey Resources Limited and reduces the amount of gold located within the project area to 21,400 ounces (Table 3); and

The best gold grade (0.70 g/t) is found within the “Fresh” tailings (Table 4).

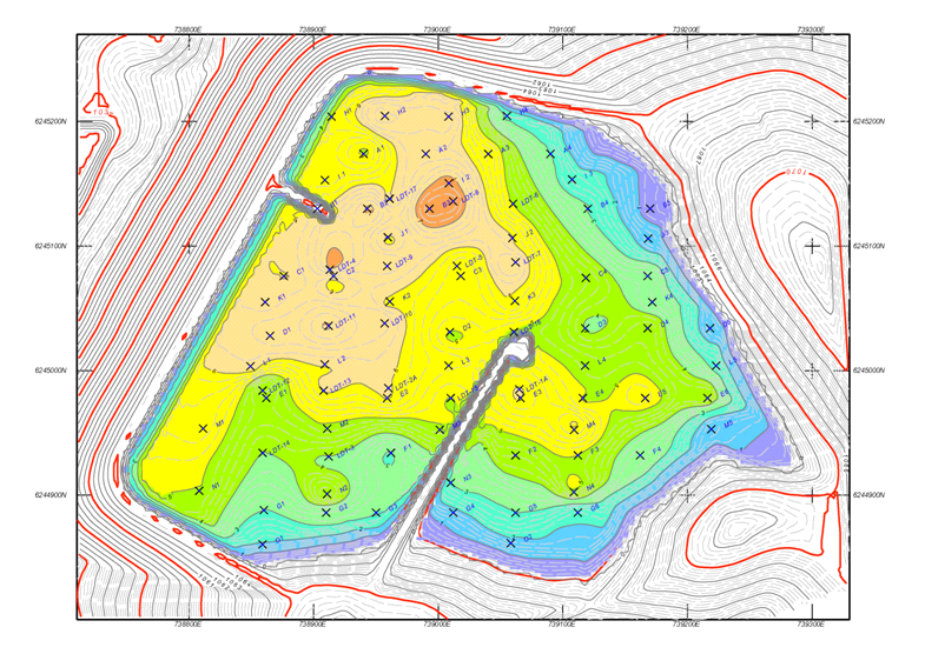

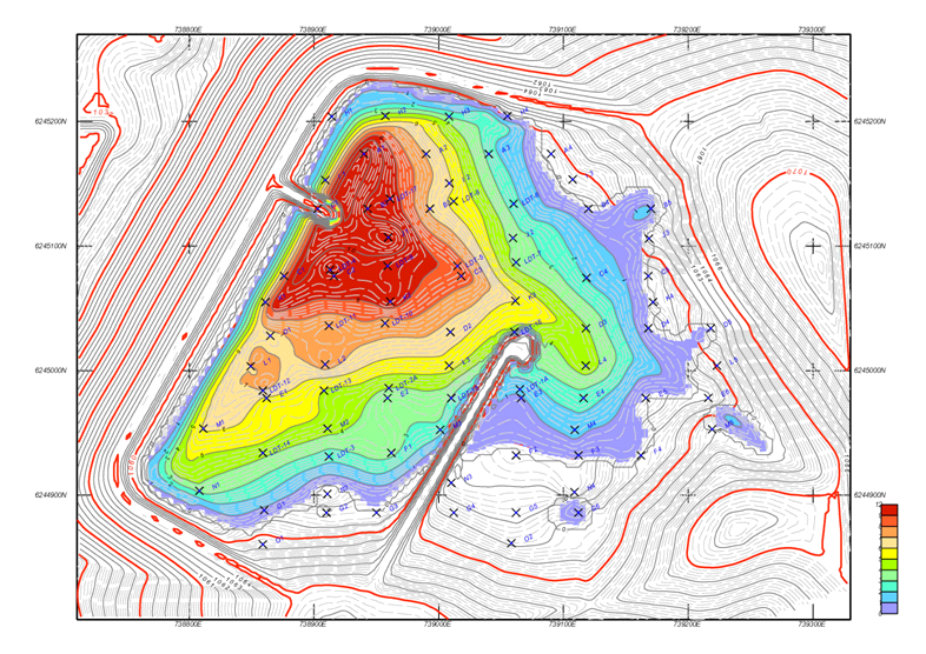

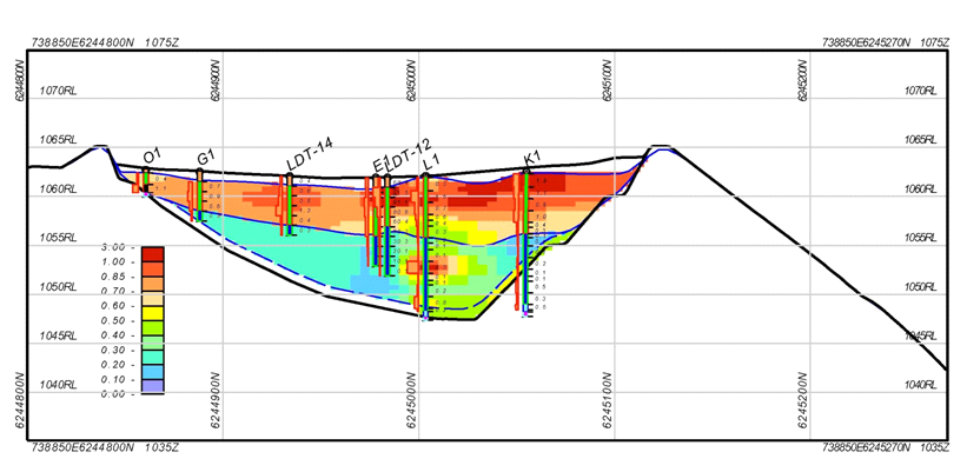

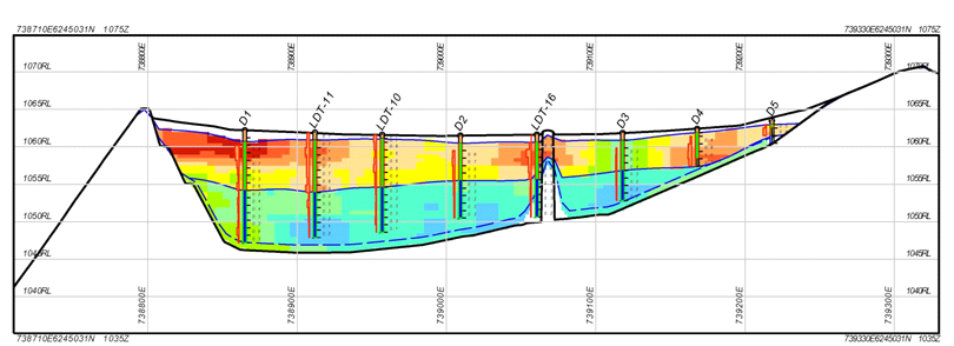

The relative thickness and gold grade of the two main layers (“Fresh” and “Oxidised”) are illustrated in Figures 5 to 8.

The physical setting of the tailings dam can be seen in Figure 9.

2.0 HISTORICAL TEST WORK AND BACKGROUND

2.1 Overview

The Lucky Draw tailings were generated from the Lucky Draw Open Cut mine which is located approximately 1 kilometer south-west of the tailings dam. The open cut mine was developed by Renison Goldfields Consolidated Ltd (RGC) during 1988 to 1992 and was the largest gold producer in NSW at the time. The proven and probable reserves at the start of operations were 1.11 million tonnes grading 3.52 g/t Au. However, a review by RGC in 1997 indicated that 1,44 million tonnes of ore had been processed and that the average grade of the tailings was 0.66 g/t Au. The following sections describe some of the testwork carried out on the tailings dam since placement.

2.2 Werrie Gold (1996-1997)

Werrie Gold drilled 23 holes into the tailings dam and obtained a number of samples that were submitted for metallurgical testing by Amdel Limited in Adelaide. The results showed a tendency towards decreasing grade towards the bottom of the holes drilled and was consistent with the observation that the oxide tailings were lower in grade than the primary ore tailings. The average gold grade obtained was 0.53 g/t Au. Furthermore, sizing of the tailings indicated that 70% of the gold is present on the -38 micron fraction, which accounts for 47% of the tailings weight. Gold extraction (cyanide leach) was found to reach a maximum over a 6 hour leach time and that extraction in the range of 60% to 75% could be achieved.

On the basis of this data, it was estimated that the tailings contained 24,560 oz of gold and that the gold recoverable by agitation leaching would be approximately 16,450 oz. It was concluded that the resource was too small to justify a dedicated operation. The gold price at the time was US$350/oz.

2.3 Marlborough Resources NL and Michelago Limited (2002)

International Project Development Services Pty Ltd (IPDS) were commissioned by Marlborough Resources NL and Michelago Limited to assess the economics of developing the tailings in 2002. Based on the IPDS review of assays by ALS on tailings recovered from a 17 hole drilling program conducted in the Lucky Draw tailings dam in 1994, IPDS was of the opinion that the average head grade of the tailings resource of approximately 1.4 million tonnes would appear to be closer to 0.60 g/t Au, and only 10% lower than the original historical operations tailings grade of 0.66 g/t Au, rather than the grade of 0.53 g/t Au reported by Phil Bush and Associates in the review of the metallurgical data carried out in 1997. This data suggested that the contained gold resources are likely to be of the order of 27,800 oz rather than the 30,600 oz indicated by historical records and the 24,600 oz expected by the PB study. Subject to confirmation of the assumptions used in the study IPDS considered that CIP treatment of the primary tails appeared to be the most promising option for the retreatment of the tailings.

At an assumed treatment rate of 500,000 tpa over 3 years, the calculated net present value (NPV) at a 20% discount rate, excluding depreciation, interest and taxes, was estimated by IPDS to be in the range of $1-2 million at a gold price of US$310-360/oz, leach recoveries of 65-70%, and an assumed capital cost of $0.5 – 2.0 million.

Equivalent whole-of-life cash generation was estimated to be of the order of $3-4 million. The possible availability of any existing regional hard rock CIP plant for reprocessing the tails at a later date would add to the economic viability and has been considered as one of the options assessed. Although the preliminary economic assessment was based on treatment of the total tailings resource, calculation of cut-off grades indicates that retreatment of the deeper and lower grade oxide tailings would appear to be uneconomic compared with the primary tails grade.

A reassessment of the project economics without recovery of the oxide tails would appear to be desirable in any follow-up studies. Heap leaching and in-situ leaching options were evaluated and found to be uneconomic due primarily to the high costs of cement agglomeration and pad building for heap leaching and the low recovery of 35% expected by IPDS for in-situ leaching. A higher recovery from in-situ leaching is considered unlikely, due to the complexity of solution movement in tailings and the generally unproven nature of in-situ leach recovery from tailings. Dam leaching would appear to offer some possibility for an expandable initially low capital cost operation, but economics are considered currently marginal unless costs of new dam extensions can be significantly reduced. Dam leaching does however offer the potential to save capital by potentially avoiding the cost of a new tailings dam. It was not known at the time whether the State Government would approve of reactivation of the old tailings dam for a new internal dam leach operation and disposal option is not known.

2.4 J Love and Meridien Resources Ltd (2007 – 2019)

The following technical work was completed by Warrinen Pty. Ltd for the tenement owners (J Love followed by Meridien Resources Ltd) under the auspices of EL 6810 during the period 19th June, 2007 to 18th June, 2010. This included:

- Re-assessment and re-evaluation of Werrie Gold’s tailings feasibility study including amended gold prices and fuel costs,

- A scoping study on metallurgical testing to be carried out on the tailings, as a prerequisite to plant design and acquisition,

- Defining issues in relation to application for a mining title,

- Acquisition of a number of historical reports on the tailings dam,

- Limited check sampling of the tailings and analysis of the samples for residual cyanide,

- Systematic drilling (40 holes) of the tailings body by a modified aircore method, and analysis of the samples for gold,

- Compilation and assessment of data obtained from the drilling programme, and rehabilitation of drill sites.

- Preliminary sampling of ground and surface water around the tailings dam, to obtain environmental baseline data.

- Infill and check drilling (30 holes) of the tailings, using a high-definition push-tube system, and collection of whole-core samples for SG determinations, chemical analysis and metallurgical testwork; including rehabilitation of the drillsites.

- Collation and compilation of all data.

Using data from several drilling programs, GeoRes calculated a JORC (2004) compliant total resource (Inferred + Indicated + Measured) of 1.5613 million tonnes at 0.48g/t gold, for 23,900 ounces of contained gold. This compares with Werrie Gold’s calculated resource of 1.4 million tonnes at 0.53g/t gold. A breakdown of the GeoRes resource estimate is provided in Tables 1-4 above.

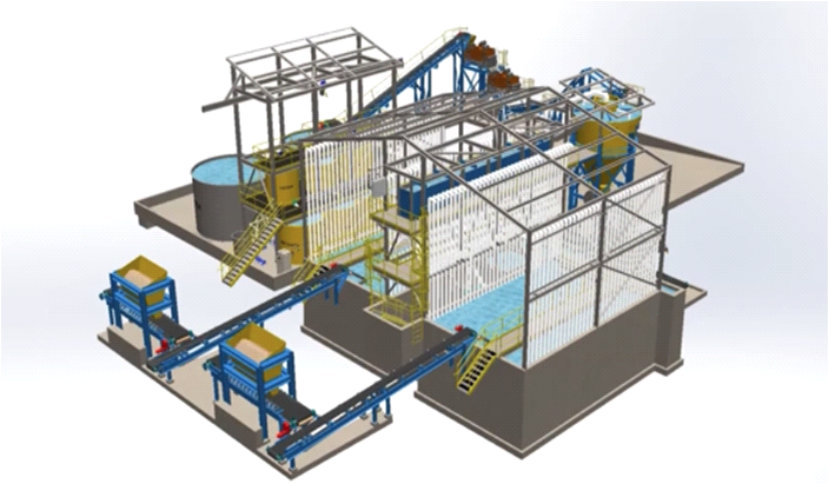

3.0 PROPOSED TREATMENT OPTIONS

The currently favoured approach to treating the tailings is via a mobile leaching system that can be placed in the dam area (as this reduces any risk of effluent discharge outside the dam area). This leaching system could be used on other like projects. The metal extraction from any pulp leaching system would be via a simple carbon column arrangement that can be either hosted within the dam or outside. This concept utilises a mechanical leaching system called Continuous Vat Leaching (CVL) and is a system developed by INNOVAT (www.vatleach.com) – Figure 9.

Destiny Resources has been collaborating with Mining and Process Solutions (www.mpsinnovation.com.au) who have agency rights in Australia for the CVL technology and are able to run pre-design tests on the tailings in Perth. The CVL process also incorporates the GlycatTM leaching technology which has been pioneered by Curtin University, via the Western Australian School of Mines: Minerals, Energy and Chemical Engineering. INNOVAT’s Continuous Vat Leaching system draws upon existing processes combining standard leaching with fluidised process beds. The result is an exceptionally small process plant with large throughput rates. Significant cost savings are realised thanks to the high process efficiency and recycling of water and lixiviant.

Maximum reliability and uptime are achieved through overall simplicity, where almost all components within the process are static in nature, and only solution circulation, and discharge mechanism are energized. Leaching progress is measured in hours, with almost no retained product inventory. The vat is continuously fed, and moves via intermittent fluidisation to the discharge point where it is dewatered, detoxified, and ready for stacking.

With the ability to accommodate all ores, and any leaching chemistry, INNOVAT’s Continuous Vat Leaching system is applicable to all leach projects whether gold, silver, copper, rare earth, reclamation, recycling, or anything in between. It is therefore considered that the INNOVAT approach has the solution to improve the economics of the project, at the same minimising environmental impacts.

4.0 PROJECT FEASIBILITY

A comprehensive feasibility study is yet to be completed as a number of inputs and options are still being determined. This includes the possibility of partnership arrangements with earthmoving companies who may wish to provide the manpower and equipment to excavate the tailings, deliver them to the processing plant and then reclaim them. Whether this is to be done by simple excavator and FELs or by hydraulics is yet to be determined. Furthermore, testing of the tailings with the GlycatTM technology is required to optimise the recovery process.

It is possible however, to estimate some capital and operating costs at this early stage, via:

Up-front and Capital costs

1 Test work, preliminary feasibility studies, preparation of environmental and planning documentation and lodgement of Mining Lease Application – $250,000

2 Capital costs for mobile Vat Model 1 (see Section 3 above)* – $1,575,000

*Throughput from 100 t/h to 600 t/h depending upon residence time

Operating costs

Operating costs are yet to be determined but some guidance can be provided from previous studies. International Project Development Services Pty Limited completed a preliminary economic assessment on the Lucky Draw Tailings in 2002 (Section 4.3 above). This study indicated operating costs for a number of treatment options as follows:

- CIP $4.10/t

- Heap Leach $8.50/t

- Dam Leach $6.50/t

- In-situ Leach $3.60/t

However, these treatment options are all based on cyanide being the leaching agent and not the Glycat TM technology. Using the GlycatTM technology, it is estimated that average recoveries of between 0.29 g/t to 0.34 g/t Au can be achieved representing 14,000 to 17,000 ounces of recoverable gold. At an Australian gold price of $2000/Oz, the value of the tailings varies approximately from $18.60/t to $21.80/t.

If processing was to be focused only on the higher-grade “Fresh” tailings (average grade of 0.7 g/t – Table 2), the value of these tailings would be around $45/t. In the event that operating costs can be shown to be in the vicinity of $10.00/t or less, robust returns are indicated.

Furthermore, no allowance has been made for any additional value that may be found in the recycled tailings as an industrial product.

It should be noted that the proposed plant will be highly mobile and will be suitable for use on other gold and base metal tailings projects – either in production mode or in pilot plant mode. Destiny Resources Pty. Ltd. is actively scoping out other like projects, with the objective of establishing a pipeline of future development and growth.

5.0 PLANNING AND ENVIRONMENTAL ISSUES

There are a number of project benefits inherent in the use of the GlycatTM technology. These include the following:

- Minimises the use of cyanide;

- More effective recovery agent than cyanide;

- The entire operation is run on site – no outside infrastructure required (water issues and logistics to be determined)

In 2012, Meridien Resources Ltd received approval from the then “Department of Trade and Investment” (Resources and Energy) to conduct a trial in-situ leach program. The approval was based on a Review of Environmental Factors (REF) prepared by the project operator – Developed Gold. The REF considered a number of factors including:

- Description of the Leaching Trial;

- Description of the Tailings Dam site;

- The existing environment (including surface/ground water regime, assessment of threatened species, populations and ecological communities;

- Aboriginal cultural heritage values; and

- Environmental Impact assessment.

No significant impacts were reported.

These data sets will be extremely useful and will be used in the future planning process for the current project.

It is noted that the land on which the tailings reside is zoned a RU 1 according to the Oberon Local Environmental Plan (2013).

Environmental facilities, extractive industries, and open-cut mining activities are “Permitted with Consent” under that zoning.

6.0 PROPOSED PROGRAM

It is proposed that the following tasks are to be undertaken:

- Complete negotiations with the land owner and Hardey Resources Ltd

- Drill test tailings and generate suitable amount of material to be tested by MPS in conjunction with the West Australian School of Mines (WASM);

- Complete contractual arrangements with MPS and WASM

- Complete all environmental assessments

- Complete feasibility study

- Lodge Mining Lease Application

It is anticipated that cost of the above will be approximately $250,000.

In the event that the above work confirms the feasibility of the project, Destiny will move quickly to secure the additional funding required to bring the project into production. Preliminary estimates indicate that approximately $1,575,000 will be required for the initial capital requirements.