HIGHLIGHTS

- Project focused on the establishment of a long term mineral aggregates (sand and gravel) business but incorporating the exploitation of potential gold resources in the immediate short term

- Project area covers very extensive expanse of Tertiary Age sand and gravel deposits with a proven track record of generating industrial aggregates with significant gold credits

- A long-life project is suggested, with engineering estimates in 1985 suggesting some 38 million cubic metres of prospective alluvial deposits in and around the Oallen area alone

- Location of project area is at the doorstep to the massive Sydney Planning Region where the development market requiring construction materials is without doubt the largest in Australia

- Future fine aggregate demand within the Sydney Planning Region is estimated to be around 75 Million tonnes between 2010 and 2020 and 245 Million tonnes by 2040

- The potential to develop cash flow from gold production in the short term offers the opportunity of funding and developing a large aggregate business over the long term

- The Project is located within close proximity to major hardrock quarry operations and associated infrastructure

- Target zone now identified for immediate resource development

1.0 PREAMBLE

The Shoalhaven Sands and Aggregates Project is seeking to exploit large deposits of industrial aggregates (gravels and sands) located in and around the Shoalhaven Valley, south west of Goulburn, NSW.

In general terms, the Shoalhaven Valley area is host to vast expanses of Tertiary age sand and gravel (aggregate) deposits which contain variable amounts of gold mineralisation. One quarrying company, Hi-Quality Quarry (NSW) Pty Ltd is currently exploiting a small area of such alluvial deposits near Oallen Ford for both gold and aggregates, hence demonstrating the validity of the model.

It is the intention of the Company to explore and develop similar alluvial deposits which cover some several hundred square kilometres located within the Company’s Exploration Licence Application. A target zone has already been identified and is ready for resource determination. The project’s gold potential is considered to represent a short term development proposal (with the objective of developing cash flow), whereas development of the sand and gravel deposits represents a long term (+30 year) potential.

The following sections detail the market fundamentals that are likely to operate in the coming decades which will justify the development of the Shoalhaven Sands Project. Furthermore, a technical background to these resources together with a development plan and budget is also outlined.

2.0 AUTHORITY DETAILS

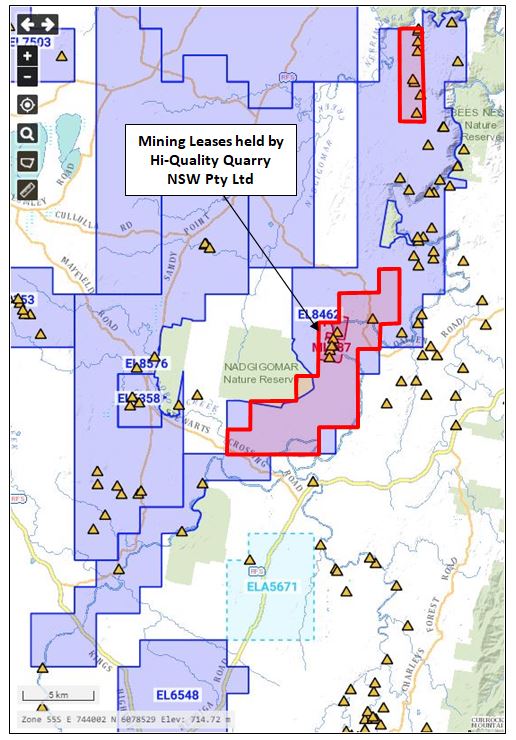

Exploration Licence 8462 is located in and around the Shoalhaven River valley. The licence was granted on 8/8/2016 over an area of around 500 square kilometres. An application to renew the licence over a smaller area comprising of approximately 86 square kilometres was lodged in 2018 and a decision to approve this renewal for a period of two (2) years was received by the NSW Department of Environment and Planning on 10/10/2018. The expenditure commitment for Year 3 is $32,000.

Access to the licence area is afforded by Windellama Road located to the west and then by numerous tracks and farm access roads. The location of the licence area is illustrated in Figure 1.

3.0 REGIONAL GEOLOGY

The regional geology is dominated by Cainozoic/Tertiary sediments overlying a basement of Ordovician undifferentiated metasediments. The Cainozoic sequence is composed either of fluvial deposits of gravel, quartz, sandstone or siltstone together with quartz sandstone, conglomerate, ferruginous sandstone, ferricrete, silcrete and laterite. These deposits occupy a large portion of the Shoalhaven River valley. In many locations near the Shoalhaven River, these deposits are auriferous.

4.0 MINING HISTORY

Gold has been known in the Shoalhaven River valley since 1851. In the Oallen area, the presence of alluvial gold in high level gravel deposits has been known since the late 1800’s and a number of attempts at exploitation, using both sluicing and dredging techniques, have been made. Recorded production between 1878 and 1901 is 14,177 ounces (44lkg) although actual production is thought to be considerably higher.

and gold mineral occurrences (yellow triangles)

D.S.L. Clift (1975) of the Geological Survey of N.S.W. reported in some detail on the history of alluvial gold mining in ‘Gold Dredging in New South Wales’ and the historical information which follows has been compiled from Clift’s text. Shafts sunk in 1885 on alluvial flats in the Oallen Crossing area near M.L.’s 887 and 888 recorded gravel depths of from 7.6m to 13.7m and yielded values of between 0.51 and 2.3g/m. In 1890 shafts in the same locality yielded up to 20.34g/m3 from a 12 metre depth of gravel. Higher level gravels worked in this area in 1904 returned an average of 8.14g/m3 from 380m3 of treated material. Dredging operations at Oallen commenced in 1932 and a number of companies operated in the area until 1937 with only limited success. Grades had been estimated at approximately 0.3g/m3 but subsequent recoveries fell far short of the early estimates.

The project area lies to the north of the Braidwood Mining Division where over 630,000 oz of gold was recorded from alluvial gold workings. Early workings were confined to the banks and bed of the Shoalhaven River and some of the smaller tributaries.

Dredging near Warri Bridge between 1910 and 1913 yielded 3,303 oz (103kg) of gold from 1,353,841m of alluvial material. This computes to an average recovered grade of 0.076g/m3. It is, however, clear that the dredge treated everything from grassroots to a depth of five metres, in spite of the fact that sandy loam with a negligible gold content up to three metres in depth covers much of this particular river terrace. Losses of fine gold, a problem which can only now be overcome with modern gold-saving techniques, would have been high.

The only historical data available for the Larbert area is some minor production from gravel pump operations between 1935 and 1937 which yielded 2,846 g of gold from 22,293m3 of material, or an average recovered grade of 0.128g/m3.

5.0 RECENT EXPLORATION OF THE SHOALHAVEN ALLUVIALS

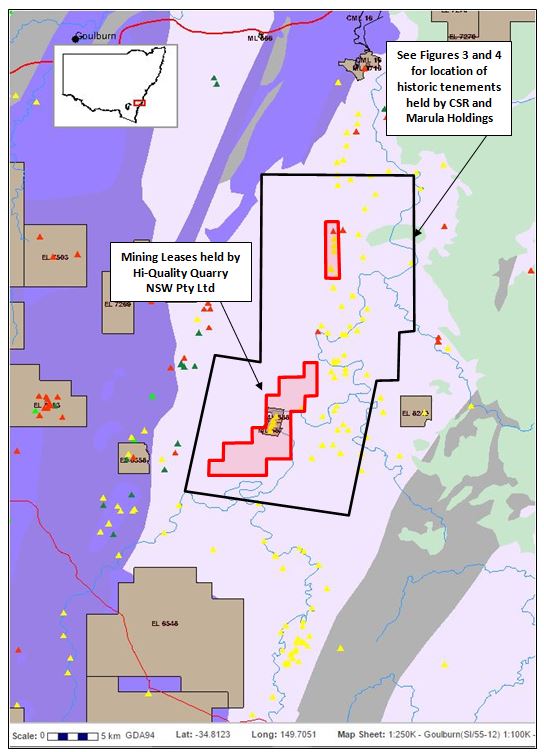

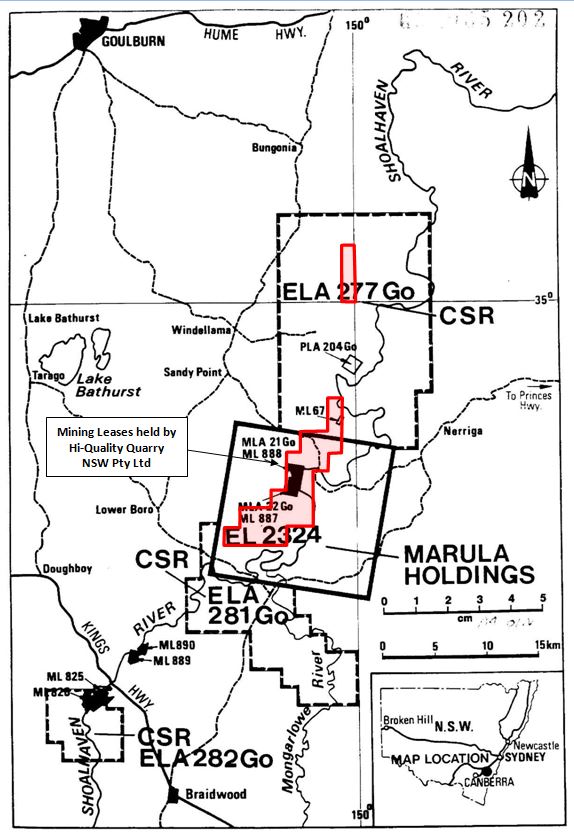

The reporting of exploration activities in the modern era can be found in a number of references including an independent geological report (Seymor, 1985) and an independent engineering report (Terrence Willsteed & Associates, 1985) prepared for Abaleen Minerals NL in connection with a proposed listing of that company on the Australian Stock Exchange. These exploration activities were restricted to several exploration and mining tenements (see Figure’s 2 and 3) held by Marula Holdings Pty Limited (its wholly owned subsidiary at the time) and included:

- Warri Bridge (ML’s 825 and 826);

- Larbert (MLs 889 and 890); and

- O’allen (ML’s 887 and 888 and EL 2324)

A.O.G. Minerals Pty. Ltd. tested the older, Tertiary gravels along the Shoalhaven River for a distance of approximately 16km in 1969. Excluding the recent gravels and areas under cultivation, they estimated the volume present to be 7.87 million cubic metres with an average grade of about 0.009g/m. It was subsequently concluded that the recent Shoalhaven gravels were of greater potential, yet no details were given.

In the Warri Bridge area, a scout Gemco auger drilling program was conducted in 1974. A total of 28 holes were drilled across a river terrace immediately north of the dredged area described earlier. This work indicated that there were three generations of fluviatile sediments present, namely, poorly exposed but extensive gravels in a terrace six metres above river level, less extensive gravels covered by river sand and sandy loam three metres above river level, and the present river sediments. These previously undetected paleochannels were considered to be high priority targets by Terrence Willsteed & Associates.

The average depth of the holes was 10.3 metres and volume calculations indicated the presence of 1.38 million tonnes of alluvium. The average gold grade was reported as 0.51 g/m. Subsequent re-analysis of the drill data in conjunction with historical production records by Consulting Engineer E.H. MacDonald and Consulting Geologist L.J. Lawrence suggested that the average grade obtained from the auger drilling program was highly inflated and that the recoverable grade was more likely to be in the vicinity of 0.18g/m3.

In the Larbert area, bouldery point-bar deposits have formed at the base of the Warri gorge where the course of the river is deflected towards the east by the Durran Durra fault. A gravel terrace had developed where the river again turns north towards the mouth of Reedy Creek. Sand deposits predominate over gravel outside of these two fairly restricted areas. The presence of fine alluvial gold has been confirmed at both Warri Bridge and Larbert but no attempt has yet been made to establish the grade.

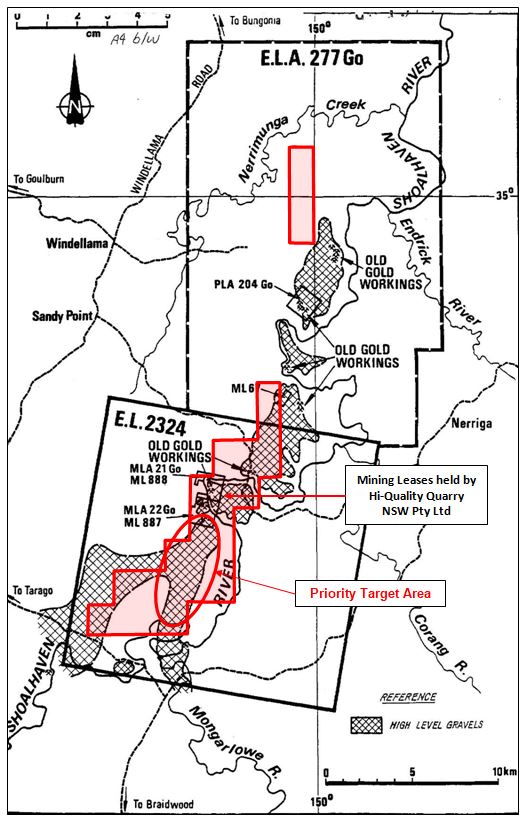

At Oallen a thick sheet of Tertiary high level gravels and sand occupy a large paleochannel of the Shoalhaven River. Numerous old gold workings, the results of dredging and sluicing operations, were exposed along the edge of the present river channel which is incised into the Tertiary deposits between the Mint (west bank) and Paul’s Cabin (east bank).

At the “Mint”, exposures of up to 10m of gravels were reportedly exposed in the walls of old workings; a similar thickness is exposed at Jessops on the north side of Spring Creek. In neither case is bedrock exposed and there is reason to believe that the gravel and sand sequence may be as much as 20m thick. These high level alluvials consist predominately of compacted gravel with clast sizes ranging from 2mm to 20cm. Cobbles in excess of 30cm are present but extremely rare, and the matrix consists essentially of fine quartz sand. Within the exposed sections a number of sand and clay beds are noted. The sand beds do contain some fine gold while the clay beds are barren. The bulk of the alluvial gold occurs in gravel beds.

The gold particles are uniformly fine-grained and a sizing analysis on a representative sample of concentrate carried out by Fox Laboratories showed that 100% of the gold was less then 1.68mm and that 68.45% was less than 420 microns in size. It is the fine grain size of the gold which has caused such acute recovery problems in the past. The gold is 98.3% pure (with 1% silver) and this high purity may obviate the need for refining.

An initial bulk testing programme under the supervision of Fox Laboratores was undertaken by Marula in November, 1983. The recovered grade of 7,000 tonnes of material treated in the plant was 0.09g/t gold. Tailing samples from the concentrates and sluice indicated a loss of 0.08 to 0.09g/t and other losses were noted in other areas of the plant. Assuming a total loss of greater than 50%, it was felt that an in-situ grade of at least 0.18g/t gold could have been anticipated.

In 1985, a testing program treated a total of 5,024 tonnes of white gravels, 3,617 tonnes of red gravels and 1,490 tonnes of mixed clayey white gravels with red overburden gravels. The recovered grade for the white gravels was 0.13 g/t Au, whereas the red gravels returned a grade of 0.045 g/t Au.

Work undertaken by Terrence Willsteed & Associates in 1985 suggested that the “total indicated resource of alluvium in the immediate vicinity of the leases (ie at O’allen) is approximately 38 million tonnes”. However, it was stressed that this figure could not be considered as “ore reserves”.

Further testing and exploration work in the Oallen area was carried out by Abaleen Minerals NL in 1985 in conjunction with C.S.R. Ltd. The program included photogeological studies, geological mapping, bulk channel sampling, large diameter Calweld drilling, backhoe costeaning, geophysical surveying (seismic refraction) and metallurgical and sedimentalogical studies. The photogeological studies and geological mapping indicated that the high level alluvials extend beyond the southern boundaries of E.L. 2324. In addition, the Calweld drilling program (eight holes to a total depth of 125m) confirmed the presence of a higher grade zone in the uppermost three metres of the white gravels in the Mint-Jessop block. Samples treated using a small pilot testing plant showed consistent grades in the range of 0.4g/m3 to as high as 1.1g/m3 over the three-metre interval.

6.0 ENGINEERING ASPECTS OF THE OALLEN PROJECT IN 1985

Terrence Willsteed & Associates in 1985, provided a number of engineering comments in regard to the alluvial gold plant that had been established to work the gold bearing alluvials in and around the O’allen leases, viz:

- A test plant used to assess the alluvials was rated at 250 tonnes/hour (or approximately 500,000 tonnes per year);

- The plant was valued then at approximately $1.0 million and was inclusive of plant, services and infrastructure facilities;

- Following the testing of approximately 60,000 tonnes of alluvials, it was determined that the gold grade averaged around 0.13 g/tonne;

- Operating costs were estimated at $1.00/tonne and was inclusive of mining, supervision, labour, fuel and power, maintenance, consumeables, exploration and grade control, plant moves and labour on-costs; and

- A specific gravity of 1.87 tonnes per cubic metre was used in all calculations.

7.0 HI-QUALITY GROUP (NSW) PTY LTD

7.1 Introduction

In 2005, the Oallen leases were transferred to Hi-Quality Quarry (NSW) Pty Ltd (HIQUAL) who operate and manage these leases to this day (http://www.hiquality.com.au/quarry/oallen-gold-mine-sand-gravel). Because Hi-Quality is a private company, the technical data and recorded activities on these leases is limited. Based on its website, the Company produces a range of gravel and sand products, viz:

“The sand produced is a fine to medium high quality silica sand that has a range of uses for construction, industrial and landscaping applications. The sand also has applications as a filter sand and drainage medium. The gravel has a range of uses for construction, industrial and landscaping applications.” Quarry products include:

- Coarse washed sand;

- Natural round river gravel aggregates; and

- Natural crushed quartz aggregates

HIQUAL has made available to the Company, its latest Mine Operation Plan (MOP) and Rehabilitation and Environmental Management Plan (EMP) (Hi-Quality Quarry (NSW) Pty Ltd, 2015) and is in addition to the MOP and EMP produced by HIQUAL in 2008 (Hi-Quality Quarry (NSW) Pty Ltd (2008). Both documents provide significant insights into the technical and regulatory aspects of the Oallen leases. The most significant points arising from the two documents are summarized in the following sections:

7.2 MOP/EMP 2008

The main points from the 2008 MOP include:

- Development consent (EPL 12960) provided for the extraction of up to 500,000 tonnes of sand and gravel per year,

- The percentage of sand and gravel within the deposit ranges from 35% to 83%, and averaging equal to or greater than 55%. Sand and gravel reserves comprise on average:

- 45% quartzite pebble (>6mm).

- 45% silica sand (<6mm).

- 10% silt and clay.

- The MOP/EMP indicated that gravel and sand extracted and processed were to be marketed as Silica Sand and industrial minerals and the Silica Quartz as an Industrial mineral and decorative stone. In addition, various sand fractions will be sized into a range of individual sizes to enable them to be used as filter sand and or a drainage medium.

- A new raw feed processing operation and gold recovery plant incorporating a Falcon SB2500 concentrator was installed during the previous MOP period. This plant was considered to be the most efficient gold recovery system for the Oallen alluvials.

- Testing of the sand and gravels indicated that the products had considerable value in the industrial, concrete and asphalt markets and were in high demand in the local area for local developments such as Highway 92.

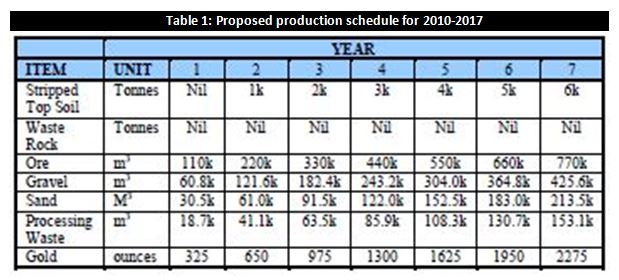

Despite having consent for a higher rate of production, HIQAUL estimated that it would only extract and produce approximately 110,000 cubic metres (or just less than 200,000 tonnes) per year as outlined in Table 1. As a consequence, it was anticipated that a total of 9100 ounces of gold would be produced with an anticipated gold grade of approximately 0.053 g/tonne or 0.093 g/m3. It is noted that that this anticipated grade was more than half of that achieved in 1985 and reported by Terry Willsteed & Associates.

It is unclear at this stage whether the Hi-Quality Group were able to achieve the above production scenario.

7.3 CURRENT STATUS

The Oallen leases were visited in February 2017 with the view to assessing the HIQUAL operations and discuss potential development options between HIQUAL and CMM. An overview of their operations is illustrated in Plates 1 to 7 below:

Based on discussions with HIQUAL and a review of the MOP for 2015, the following points are noted:

- It appears that the project was beset with operational and regulatory problems resulting in limited production from the leases during the 2008 MOP period (ie, from 2009 to 2015). However, these issues appear to have been resolved, with production set to be ramped up in 2017;

- A limited testing program was carried out in 2010. The processing of approximately 1300 m3 of gravel yielded almost 6 ounces of gold at an average grade of 0.15 g/m3. The range of recovered gold values varied between 0.03 and 0.48 m3;

- Based on a maximum approved rate of production of 58,000 m3/pa and an average recovered grade of 0.15 g/m3, it is estimated that the project will yield roughly 279 ounces of gold per year;

- Processing of the extracted material would, in addition to the gold, result in the following range of products:

- Quartzite – industrial mineral applications and speciality products;

- Gravel; and

- Sand – coarse and fine.

- Mining is expected to be carried out in stages with extraction depths ranging from 6 to 10 metre. At this stage, HIQUAL believes that its maximum production for the foreseeable future would be limited to around 100-120,000 m3/pa; and

- A number of areas within the leases have been targeted for exploration activities in the near term.

In addition, HIQUAL has indicated that it would be able to assist CMM in terms of providing facilities to enable the treatment of any bulk samples that CMM may generate from the exploration licence area. Furthermore, the potential of a farm-in to CMM’s licence area by HIQUAL was also a possibility upon CMM presenting a cogent business plan.

8.0 TARGET ZONE IDENTIFIED

8.1 Assessment of Exploration Potential

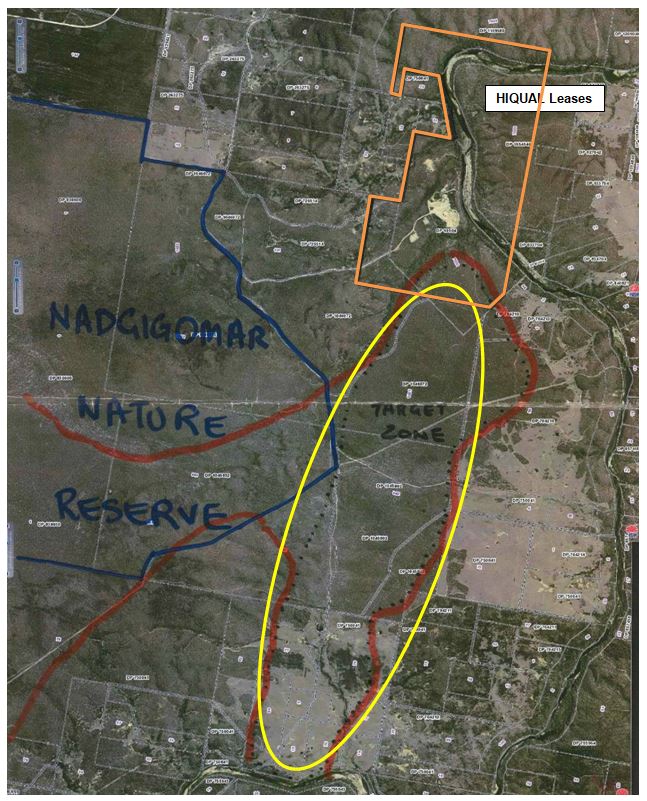

An overview of the prospectivity of the licence area was carried out during the first reporting period and focused on the assessing the extent of the Tertiary alluvial deposits located within the licence area. Specific attention was paid to the Mogo Road South area, which is located immediately to the south of the HIQUAL operation.

8.2 Mogo Road South Area

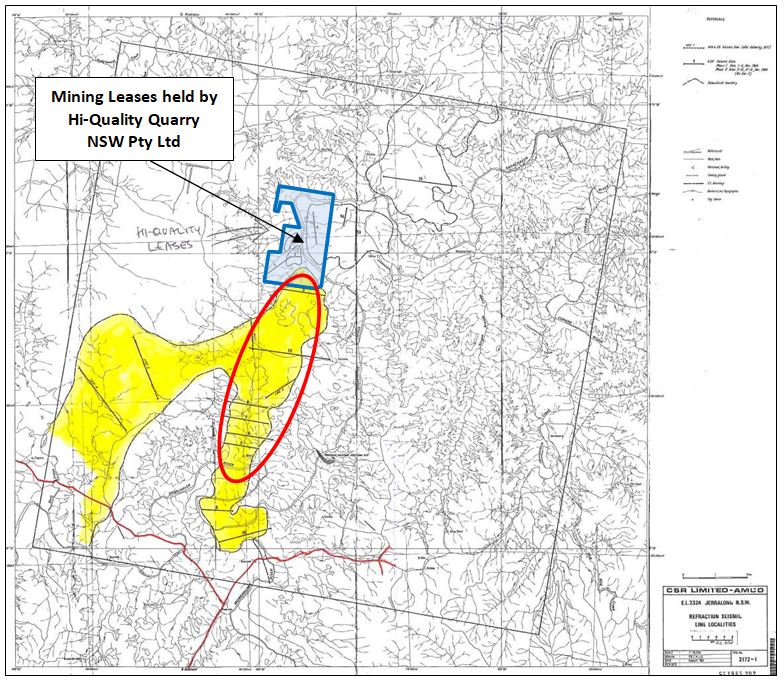

The Mogo Road South area is of interest given its proximity to the HIQUAL leases and accessibility to this area is very good. The prospectivity of this area was first defined by CSR Limited in 1985 by surface mapping and seismic surveys, which delineated large areas of Tertiary sands and gravels – see Figure 5.

Within this target zone, these sands and gravels cover an area of approximately 6 kilometres X 1 kilometre. With estimated depths to basement varying between 5 and 15 metres, the volume of this material is potentially very large.

Field assessment by the Company has confirmed that an area measuring approximately 6 x 1 kilometres contains extensive deposits of sand and gravels – see also Figure 6.

9.0 OVERVIEW OF CURRENT SOURCES AND POTENTIAL MARKETS

Construction materials such as gravel, sand, clay are a fundamental (if somewhat unglamorous) component of the mineral resource base of any developing/developed economy. Construction materials are typically a high bulk low unit cost commodity sourced close to market so as to minimise transport costs internationally and nationally. Construction materials are/have been sourced from a range of terrestrial, river, estuarine and marine environments adjacent to main population centres. Increasingly, competition for land around major cities forces suppliers further afield, effectively increasing the “footprint” of a city’s resource base This reality has been the driver for a number of resource companies exploring the “marine aggregate option” for Sydney for example (Skene, D. 2012).

The Sydney Planning Region (SPR) uses about 20 Mt of fine and course aggregates, including up to 7 Mt of fine aggregate (sand) annually (Skene, D 2012). The predominant use for these aggregates is ready-mixed concrete, concrete products, mortar and fill. Forty eight percent (48%) of these aggregates is composed of fine to medium grained sand, 36% is medium to coarse grained and 15% is clayey sand. The price and demand for particular forms of sand are determined by use and distance from the source to the market (RW Corkery, 2011).

In 2010, 85% of SPR construction sand demand was obtained from deposits in the Hawkesbury-Nepean River, Georges River (medium to coarse sand), Kurnell sand dunes (fine to medium sand) and from friable Hawkesbury Sandstone (clayey/mortar sand) The SPR imports approximately 900,000 tonnes of construction sand from outside of the region. This is set to rise as traditional sources are exhausted, notably Kurnell and Penrith Lakes.

Skene, in 2012, indicated that there was a looming construction sand supply shortage emerging in Sydney. Significant shortfalls were expected as traditional sources are being exhausted and operations cease, viz:

- Penrith Lakes (2012-14) 4.3 Mtpa (1.9 Mt F-C sand, 2.4 Mt gravel)

- Kurnell (~2014) 1.5 Mtpa (F-M sand)

Future fine aggregate demand within the SPR is estimated to be around 75 Million tonnes between 2010 and 2020 and 245 Million tonnes by 2040.

It was considered that shortfalls would have to be met by increased production from friable sandstone areas within planning region (Maroota and Somersby) and/or from imports outside the SPR (Newnes Plateau, Southern Highlands and Stockton). Several proposals over the years to extract sand and other aggregates from off-shore deposits have failed due to environmental reasons (Quaternary Resources Pty Ltd, 2005).

Whilst most offshore development proposals have been stymied and other hardrock developments inland have stalled, there has been an increasing shift by the quarrying industry to develop supply along the southern Hume Highway development corridor. In particular, the area around Marulan-Goulburn has become a major zone for large scale hardrock quarry developments. Some of these developments individually are focused on exporting up to 3 million tonnes per year of various quarry products to the greater Sydney. In some cases, a significant effort has been made to develop the necessary supporting infrastructure to facilitate quarry development and transport facilities (see Appendix 1).

The Shoalhaven Sands project represents an opportunity to establish a multi-product source that could meet some of Sydney’s future aggregate requirements. The location of the Project close to the Marulan-Goulburn quarrying “hub” may provide opportunities for joint venture as well as providing potential access to well established transport options.

In addition, the project is well positioned to meet the future requirements of large infrastructure projects like the High Speed Rail (HSR) connection between Sydney and Melbourne. This proposal is being developed under the Consolidated Land and Rail Australia (CLARA) concept (www.clara.com.au). This concept entails the construction of a number of “Smart” cities, which “can deliver critical mass in passenger numbers for the HSR network, as well as unlock the significant financial benefits to the Australian economy of inland city development. We have developed a plan that will allow for a quantum leap forward in the development of our nation to take place as a market-led, commercially viable project.”

It is understood that one of the proposed “smart cities” will be Goulburn – see Figure 7.

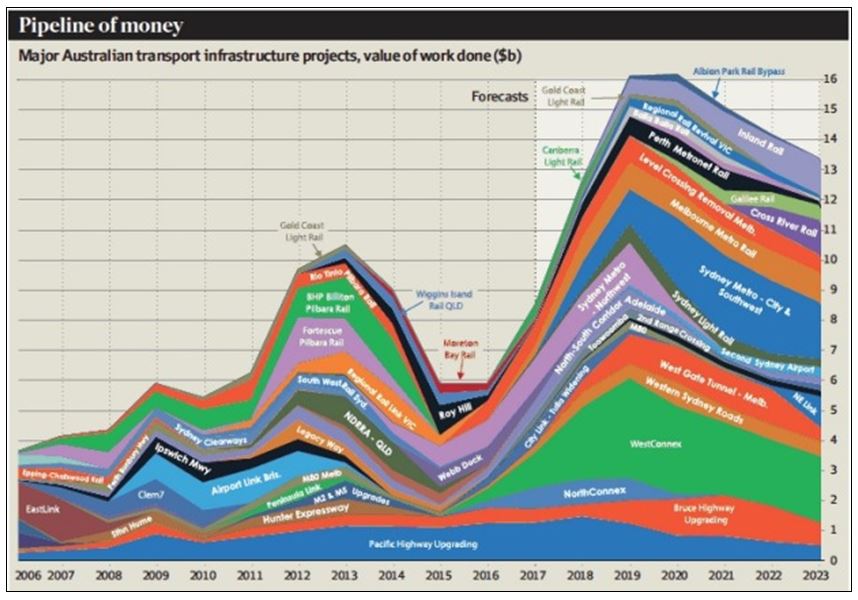

As an indication of the coming potential for infrastructure related industries, the following excerpt from the Australian Financial Review (Jacob Greber, 22/9/2017) is instructive, viz:

“Australia is on the cusp of the biggest wave of public infrastructure spending in at least three decades and has already ensured a record proportion of construction workers have found jobs.

In a shift that has been overlooked amid the focus on negatives such as high household debt, weak consumer sentiment and low wages growth, research published this week shows almost $100 billion in local, state and federal government spending will hit the economy this year financial alone (see Figure 8).

According to a chart presented by Reserve Bank of Australia governor Philip Lowe in a speech in Perth this week, public infrastructure work “yet to be done” will be just under 6 per cent of nominal gross domestic product in 2017.

That figure is set to keep rising, with transport projects alone set to boom for much of the next five years, and peak three years from now in 2020, according to research by economic consultancy Macromonitor.

Public infrastructure work “yet to be done” will be just under 6 per cent of nominal gross domestic product in 2017. Macromonitor. Craig James from Commsec says that while bad news about the economy draws people’s attention, new infrastructure spending is likely to be comparable or larger than what was invested during the resources boom of the past 15 years.

“It’s a huge amount, one and half times the size of the mining boom, and people tend to lose sight of it because it’s scattered around Australia,” he said.

Mr James predicts the project boom is a key reason the Reserve Bank’s forecasts for economic growth of 3 per cent will become reality. “We’ll see tightening in the jobs market and wages will creep higher – which we’re already seeing in some elements of the construction sector.”

Data published by the Australian Bureau of Statistics this week confirms that construction is Australia’s hottest job creation sector. The labour market has just gone through its strongest six month stretch of job creation – with employment rising by 273,000 – in records going back almost 33 years. Construction jobs devoted to new roads, bridges, tunnels, hospitals and schools rose by 64,400 in the second quarter, and now accounts for a record share of workers, just shy of one-in-10”.

10.0 CONCEPTUAL MINE PLAN

A conceptual mine plan is to be developed subject to the following assumptions:

- CMM would establish its own retail outlets for non-gold products;

- Commence a feasibility study to consider likely costs and revenue streams from the quarrying and processing of up to 1.0 million tonnes of raw feed per annum;

- The capital cost for the project (estimated to be less than $5.0 million) is raised by an IPO; and

- Project has a +30 year life.

11.0 RISKS AND OPPORTUNITIES

As with all resource projects, there are significant risks associated with the Project. These include the following:

- Distance from market

- No current consumer client base

- Securing property owner agreements over aggregate resources

- Environmental (flora/fauna, potential pollution, etc)

- Transport of product for the first 30-40 kilometres cover country roads which have potential capacity constraints

Potential opportunities include:

- Very long–life project (+30 years)

- Able to meet multiple product supply requirements

- Gold potential could be early cash generator and underpin initial project capital requirements

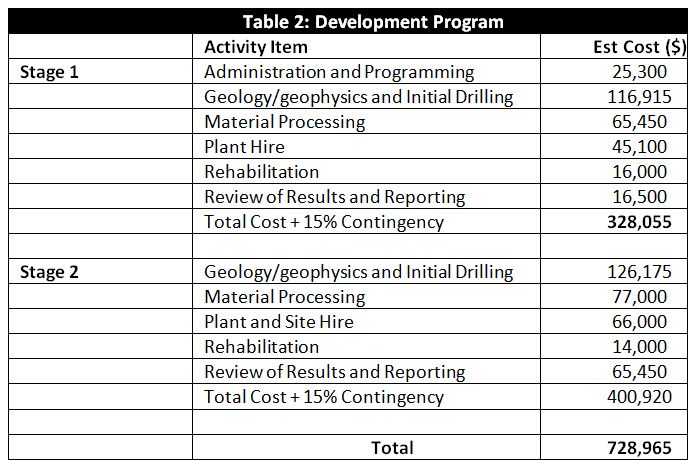

12.0 DEVELOPMENT PROGRAM

It is proposed that the following program of work be completed over the target area during the next 12-18 months. This will entail the following staged activities; viz:

Stage 1 and 2 Activities:

- Complete comprehensive geological and geophysical programs

- Execute extensive drilling and material processing over target area

- Calculate resources in target area to JORC 2012 standard

- Apply for mining lease(s) under Mines Act (1992) to develop gold resources and incorporate aggregate production

- Commence development approval process

The budget for these activities have been estimated to cost approximately $730,000, details of which are outlined in Table 2. Upon the completion of this work, it is anticipated that the scale of the potential resources will become evident, hence enabling the commencement of preliminary feasibility studies ahead of development.

It is anticipated that the above program will result in a major upgrade in the value of the project.

The above activities and costs are estimates only and may vary over time as results and observations are assessed and interpreted over time.

Upon the completion of the above program, the following Stage 3 activities are envisaged as part of the full development of the project:

- Large scale bulk testing (up to 10,000 tonnes);

- Complete approval process for one or more targeted areas;

- Determine optimum plant configuration

- Assess all necessary infrastructure requirements;

- Determine water supply (either/or dams, bores and water rights to Shoalhaven River)

- Obtain all necessary approvals for production.

Costing for this Stage 3 works is estimated at between $3.0 and $5.0 million.

13.0 REFERENCES

Clift, DSL (1975). Gold Dredging in New South Wales

Hi Quality Quarry (NSW) Pty Ltd (2008). Mine Operations and Rehabilitation and Environmental Management Plan – Extractive Industry at Mining Leases 887 and 888, Mongo Road, O’Allen Ford NSW.

Hi-Quality Quarry (NSW) Pty Ltd (2015). Oallen Gold Mine – Mining Operations Plan (31 May 2013 to 31 May, 2020)

Quaternary Resources Pty Ltd (2005). Sydney’s Construction Sand Market & the Potential Role Of Marine Aggregate. Presentation at CSIRO Deep Blue Minerals Workshop.

RW Corkery (2011). Environmental Assessment for the Green Valley Sand Quarry.

Skene, D (2012). Sydney Marine Sand Pty Limited, 2012. The Case for Marine Aggregate (Sand) Extraction from Commonwealth Waters off NSW – A Fresh Approach to Extractive Resource Management in NSW.

Terrence Willsteed and Associates (1985). Consulting Mining Engineers Report (as an inclusion in an Information Memorandum to be issued by Abaleen Minerals NL in connection with an application to list its shares on the Australian Stock Exchange).

The following web sites: